Online-only chequing accounts don't usually charge any monthly fees and charge only minimal or zero transaction fees. TD Bank offers student checking accounts for those between the ages of 17 and 23 who are full-time students. However, when you turn 24, the bank account will automatically transition to a Convenience Checking account, where you must abide by the minimum daily balance required or pay a monthly maintenance fee. Therefore, as you get close to your 24th birthday, keep an eye on your balance and current guidelines for the standard TD checking account so that you don't get hit with unexpected account fees.

To get a sense of how the online banking options in Canada stack up against each other, we looked at the platforms of some of the Big Five banks, plus some branchless banks and credit unions. We compared the account types each bank offers; their interest rates for savings accounts; monthly fees; minimum account balances required to negate those fees; and other important features. Are you interested in investing in the sense that you'd like to be better about saving money and earning passive income from things like interest?

If so, many online banks that offer comprehensive financial services (chequing accounts, savings accounts, investment accounts, credit cards etc.) will be able to help. However, before calling a representative and asking for advice about what accounts to open, know that they'll only recommend their own bank's products. If you find a bank with an investment department and options that look enticing, then you can call and ask about them specifically.

With over 1,250 locations throughout the Northeast and Southeast regions of the U.S., TD Bank offers a robust brick-and-mortar presence and an array of checking and savings account options. For consumers who value banking with a big brand that has a large physical footprint, as well as those who prioritize checking and savings accounts that offer competitive sign-up bonuses, TD Bank could be a good choice. However, compared with other banks — particularly online banks — TD Bank falls short in terms of offering competitive rates and minimizing fees. However, the Beyond Checking account offers a wider range of benefits. Banking customers have a few ways to waive their monthly fees.

They can meet the minimum daily balance, as explained, hit a monthly direct deposit minimum, or meet a minimum balance across all their eligible TD bank accounts. This account also offers no ATM fees and reimbursement on some wire transfers. Holders can even get reimbursed for overdraft fees two times per year. As a new resident, you won't be eligible for these top-tier rewards credit cards right away. Even with exemplary credit in Italy, Canadian banks require you to start from scratch.

We've written a handy article on the matter for prospective new immigrants like yourself, and if you need any help understanding it, just let us know. The first step is always to get your hands on a secured credit card, which gives you access to payments online, virtual banking, credit to pay bills with, and financial flexibility. You don't need a credit score or credit history to get this card and using it will help you improve your score over time.

Eventually, you'll work your way up to an unsecured card that you don't need to deposit cash for. If you move your chequing to an online-only bank then these options will be even more accessible, and you can access cash by making withdrawals at an ATM via your new card. TD offers clients the possibility of opening a personal foreign currency account in pounds sterling.

Customers who maintain a balance of at least £500 at the end of each month pay no monthly fees whatsoever. You get unlimited transactions with no fees, but you can't bank via ATM machine, EasyWeb, or debit payment. This option can work well for those who meet the monthly requirements to waive the monthly maintenance fee, for example, established professionals who are enrolled in direct deposit.

However, students who may struggle to meet the requirements to waive the fee on the Beyond Checking account will find that Convenience Checking offers an excellent option. The Convenience Checking account comes with a waived minimum balance, no monthly fees and free overdraft protection. We'll try to address everything in order and help you make sense of the modern banking system.

The first thing to realize is that all banks are connected, both online and offline, and so you ultimately have a ton of choices when it comes to which bank you prefer or which account. If you want to move from a traditional bank just to avoid fees, you should know that even online banks and accounts still carry a monthly fee , and those without a fee offer limited benefits . That said, we can still help you find a good low-or-no-fee chequing or savings account, depending on what you want. The Scotia One Account, and the Tangerine Daily No-Fee Chequing Account are both solid options.

Basic savings accounts are widespread – you'll just need to link your online savings account with either an online or brick-and-mortar deposit account so as to manage deposits and withdrawals. Many online savings accounts offer mobile cheque deposit to make deposits faster and easier. Some online banks also offer kids' and youth savings accounts, money market accounts, CDs and high-interest savings accounts. Tangerine Bank routinely offers bonuses when you open a new chequing or savings account. Unlike the big banks, Tangerine savings and chequing accounts do not have a monthly fee and they pay you interest on your chequing account balance. TD Bank offers several checking account options, including a student checking account that will benefit many different customers.

These accounts generally work best for those who can meet the requirements for waiving maintenance fees, either as a student or by maintaining a minimum daily deposit. Brick and mortar is for great, reliable, accountable service while online banks can be good for someone who prefers less direct control. CIBC offers a wide variety of account types, high interest rates for savings accounts, and low monthly fees. They support online bill pay, Interac e-transfers, mobile cheque deposits, debits, contactless payments, money orders and cheques.

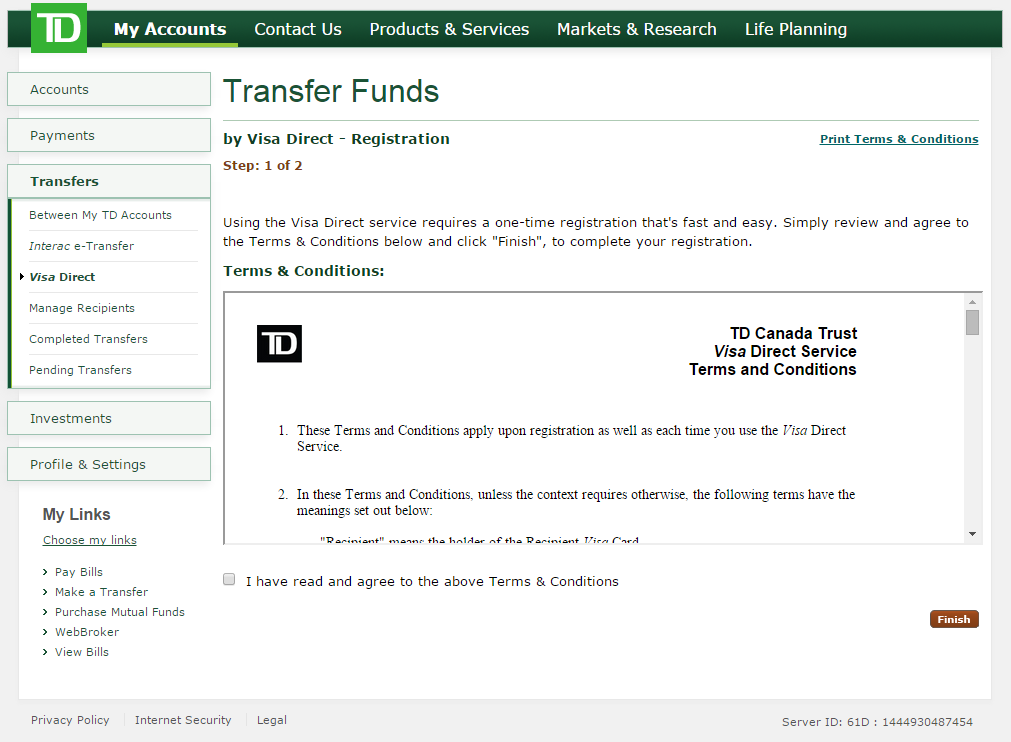

Like BMO, TD's savings account interest rates are relatively unimpressive, but its account balance thresholds for waiving monthly fees are relatively low. TD supports online bill pay, bank transfers, debits, cheques and mobile cheque deposit. Like senior accounts in brick-and-mortar banks, most online senior chequing accounts offer unlimited transactions and discounted fees on actions that are charged, such as Interac e-transfers. Senior savings accounts usually don't charge any monthly fees and offer higher interest rates than the equivalent accounts in brick and mortar banks. This is because online-only banks save on the overhead of running physical branches and can pass those savings on to the customer.

Virtually all traditional brick-and-mortar banks offer some form of online banking today, though the scope of online banking capabilities varies from one bank to the next. Traditional banks do offer low-fee chequing accounts, which enable you to make transfers, check your account balance, and pay bills online, just like with online-only banks. Small business clients are offered foreign currency accounts in several denominations.

There's sadly no information on the foreign currency accounts that you can get, besides US dollar ones. Instead you need to visit a branch for details, as their Small Business Foreign Exchange page instructs. A modern financial service like Wise uses the mid-market rate on all transfers and conversions. You pay a small fee and with it's free to open a borderless multi-currency account, that has no monthly fees either. There you can manage and send dozens of different currencies all from the same account. Soon you will also be able to get a multi-currency debit card.

In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your financial institution. One thing to note about PNC is that its monthly fees are significantly lower than TD Bank's, but PNC Bank requires a higher minimum balance of $500 to keep its standard checking account free from month to month. If you're just looking for a standard checking account, TD Bank may be an easier option for affordable checking.

Hi, is there any financial institution offering a chequing account with provision for inter-bank transfers without charging a fee for the service? I would like to open a chequing account with one institution(online bank/credit union) and maintain a high interest savings bank account with another and would want to move funds around between the two. A simpler option might be Scotia's Prepaid Reloadable Visa card. It has a $10 annual fee and free reloads, offering you the ability to shop online, pay bills and handle other necessary expenses. For you, remember that it isn't possible to avoid fees at some point when you use your money from abroad. In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your Financial Institution.

These 'Rules' are based on the reputable Canadian Code of Practice for Consumer Protection in Electronic Commerce. While we work with all stakeholders, as well as security experts, to maintain the ongoing security of our services, there are actions that you can take as well. You are encouraged to regularly check your bank statements to verify that all transactions have been properly documented. If entries do not accurately reflect transaction activities - for example, if there are missing or additional transactions you should immediately contact your financial institution.

TD checking accounts can be easily connected to savings accounts. The savings accounts can also be used as a security deposit when applying for a credit card. Students can use this card to start building their credit history with a line of credit. If I want to move from a traditional bank to avoid monthly fees, but still require cash (i.e. using the envelope method to budget) it sounds like I can't really move to an online only bank. If my mortgage or investment accounts are with a traditional bank don't I have to have a chequings account in that bank to pay the mortgage or access my investment accounts?

I feel the shackles of the brick n mortar banks tying me to them and I can't imagine how to get away. Simpliimay appear new, but they're actually the rebranded name from when PC Financial customers were transferred over to CIBC. Simplii offers a no-fee daily banking account which includes unlimited free Interac e-Transfers and a high interest savings account. Since Simplii is owned by CIBC, account holders can use their provided debit card to withdraw money for free from their network of 4,000 automated banking machines across Canada.

Most online high-interest savings accounts don't have any monthly fees, although you'll find that some have minimum balance requirements. Generally, you'll get free transfers to other accounts that you have within the same bank. US Dollar TD Every Day Business Three monthly plans with fees based on the number of transactions, 50 deposit items, and monthly fee rebates for balances starting from US$20,000. US Dollar Basic $1.25 per transaction , $0.22 per deposit item, $2.50 for every $1,000 cash deposit, $5.00 monthly plan fee. With the borderless account, your business can get its very own local bank details for several regions around the world – so your clients can pay and get paid locally.

Below is the official TD fee schedule for foreign currency accounts. They come with no transaction fees and they offer unlimited transactions. But banking via EasyWeb Internet Banking, ATM machines, and debit payment purchases are out of the question.

Customers looking for a personal account in euro can opt for a foreign currency account in exchange for a monthly fee of EUR 1.75. As above, they can make as many transactions as they wish without paying any additional service charges. However, they can't use ATM machines, EasyWeb Internet Banking, or debit payments to manage their transactions.

And there's a monthly fee of $5, which is waived if you can maintain a $300 minimum daily balance. For the first 12 months only, you can avoid the fee by transferring $25 monthly from a TD checking to savings account. For customers with larger balances, TD Beyond Savings can earn higher rates, but if your balance falls below $20,000, the monthly fee is $15. Want to send money to your child, landlord, co-worker or a friend? If they have a bank account at a Canadian financial institution, you can send money any time by using the Interac e-Transfer service available in RBC Online Banking1 or the RBC Mobile1 app. External transfer services are available for most personal checking, money market and savings accounts.

To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. Whether it's a chequing or savings account, or even credit cards and investments, customers can score 'free' cash when they open a new bank account. If you can maintain a daily balance of at least $2,500, TD Bank will reimburse you for all ATM fees incurred. Another standout checking account is TD Bank's Convenience Checking account, as it requires a low minimum balance of $100 to waive its $15 monthly maintenance fee.

Areas in which TD Bank falls short are its fees and interest offered. While many checking and savings accounts have no monthly maintenance fees without needing to meet any qualifications, many of TD Bank's products require customers to jump through hoops to get their fees waived. Additionally, the interest offered on TD Bank's deposit products is minimal when compared with the bank's online-only peers. This review covers everything you need to know about TD Bank so you can determine whether it's a good option for you. While TD Bank offers a variety of financial services, this review focuses on its checking and savings account products. Many banks require minimum balances so that they have enough funds on hand to support other banking activities, such as providing loans.

Those interested in a TD student checking account should note, as mentioned, that TD Bank doesn't charge ATM fees at its own branches or a monthly maintenance fee for those with a student Convenience Checking account. We understand the situation and believe that some of the more sophisticated online banks will be able to satisfy your needs well. As someone who is already a Canadian citizen—just living abroad—you shouldn't encounter the same obstacles as a non-citizen, though being a non-resident might throw a small wrench into the machinery. Generally, however, if you're trying to move investments to a new bank, they'll roll out the red carpet and make it pretty easy. First Ontario is a credit union, and its accountholders pay no monthly fees while enjoying relatively high interest rates on savings. First Ontario supports online bill pay, debits, bank transfers, Interac e-transfer, and personal cheques.

It permits unlimited transactions each month, and up to 5 free Interac transactions. Online banking can be a great solution for seniors, especially those who are mobility-challenged. Online senior accounts cover all of the chequing and savings needs of older customers. Seniors can access low or no-fee chequing accounts that provide a debit card and chequebook, online transfers, online statements, online bill payments, and more. Online-only banks also offer high-yield chequing accounts with higher interest rates than equivalent accounts with a traditional bank.

Like at traditional banks, you'll be restricted about how often you write a cheque or use a debit card if you take out a high-yield chequing account. If you're looking to open a new chequing account, consider one of the most recommended chequing accounts in Canada. The interbank rate, also known as the mid-market rate is something you probably want to know about. When money exchange services and banks set their own rates to sell you currency, it can be considered a additional fee. You may get very different rates, with varying levels of markup, from different providers.

And should you frequently be exchanging currency or dealing in large sums, it can add up quite quickly to bigger amounts. While it is the standard practice of financial institutions to use a markup on the rate, the downside of this practice is, that you do not know the percentage of markup that's being used. That percentage is still a cost that the buyer of the currency will take on. And as it varies by who is selling it to you, it would give a better overview of the total fees, if this was disclosed in a more clear way. Save yourself a trip to the branch or ATM and get immediate access to your money with direct deposit.